How To Find Property Tax Records

How to Find Free Property Tax Records | Pocketsense

You can locate property tax records for your property and others without having to pay expensive fees. All deeds, mortgages and related paperwork are considered public record, and can be viewed at your local county assessor or auditor's office. County Assessor and Auditor’s Searches

https://pocketsense.com/property-tax-records-24105.html

Property Records Search (Assessments, Deeds, GIS & Tax Records)

Property Records Search Perform a free public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, and liens. Find residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more.

https://www.countyoffice.org/property-records/

How to Find Property Tax Records | Finance - Zacks

In Person. Go to Tax Assessor’s office, which will likely be located in a county government building. Request the property tax records for a specific property. You might be asked to fill out a ...

https://finance.zacks.com/property-tax-records-3266.html

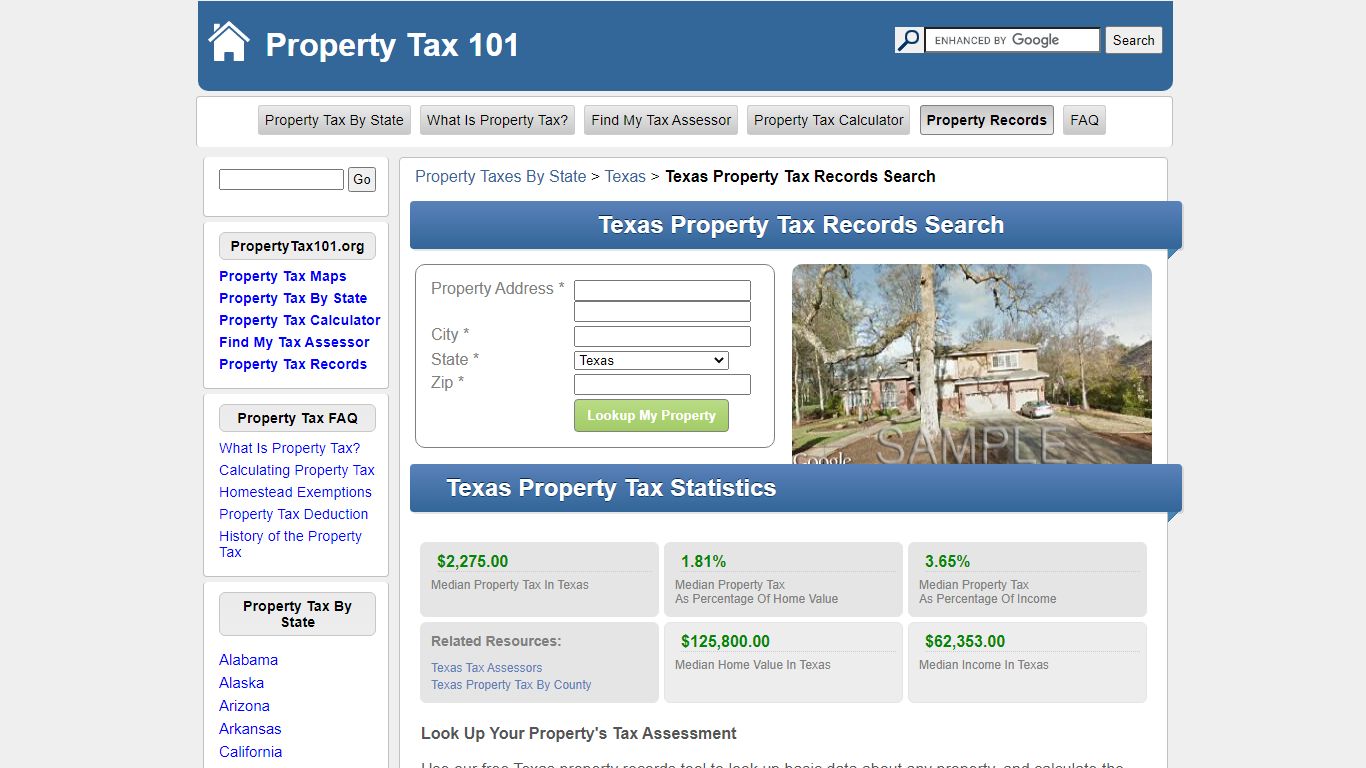

Texas Property Tax Records

Use our free Texas property records tool to look up basic data about any property, and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Our property records tool can return a variety of information about your property that affect your property tax.

https://www.propertytax101.org/texas/propertytaxrecords

Property Tax | Arizona Department of Revenue - AZDOR

1600 West Monroe Street Phoenix, AZ 85007-2650 (602) 716-6843 [email protected] Property Valuation Property in Arizona is classified and valued in each county by the County Assessor, with the exception of centrally valued property, such as airlines, mines, railroads, and utilities, which are valued by the Department. Property Taxation

https://azdor.gov/businesses-arizona/property-tax

Property Tax Division | NCDOR

All public service company property is appraised by the Department of Revenue and the appraised values are allocated to the proper taxing jurisdiction for billing and collecting. For information regarding your property tax bill (real property and motor vehicles), contact your local property tax office ( county telephone numbers ).

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-division

how to check the tax record of the property - HAR.com

Laura Soto. A few options - from phone app: tap on the 3horizontal lines on the bottom right hand side and scroll down to realist tax search. From the website: log on to your HAR account, on the portal go to the tax tab. Or Hcad.org and do a property search.

https://www.har.com/question/6406_how-to-check-the-tax-record-of-the-property

Texas Property Tax Directory | Texas.gov

Texas Property Tax Directory Texas Property Tax Directory Use the directory below to find your local county’s Truth in Taxation website and better understand your property tax rate. Learn about Texas property taxes Anderson County Andrews County Angelina County Aransas County Archer County Armstrong County Atascosa County Austin County

https://www.texas.gov/living-in-texas/property-tax-directory/

Property.mt.gov - Montana Department of Revenue

Property.mt.gov is an easy-to-use tool for finding property information. Property.mt.gov lets you Check the characteristics of your property with the Property Report Card, Locate property using the statewide Parcel Map, Review the Certified Values of property in your county or area, Find tax exempt property in each county, and

https://mtrevenue.gov/online-services/my-property/

Property Tax - Department of Revenue - Kentucky

Various sections will be devoted to major topics such as: the assessment of property, setting property tax rates and the billing and collection process. Different local officials are also involved and the proper office to contact in each stage of the property tax cycle will be identified. Additionally, you will find links to contact information ...

https://revenue.ky.gov/Property/Pages/default.aspx